A holiday in the Maldives is an experience described almost entirely by superlatives. From exclusive uber-luxury island resorts to intimate community-based guesthouse retreats, our islands have time and again been hailed as nothing short of paradise on Earth. Our sun-kissed, pristine beaches and crystal clear waters are leagues ahead of the rest, and they have consistently won us top honours at global travel awards.

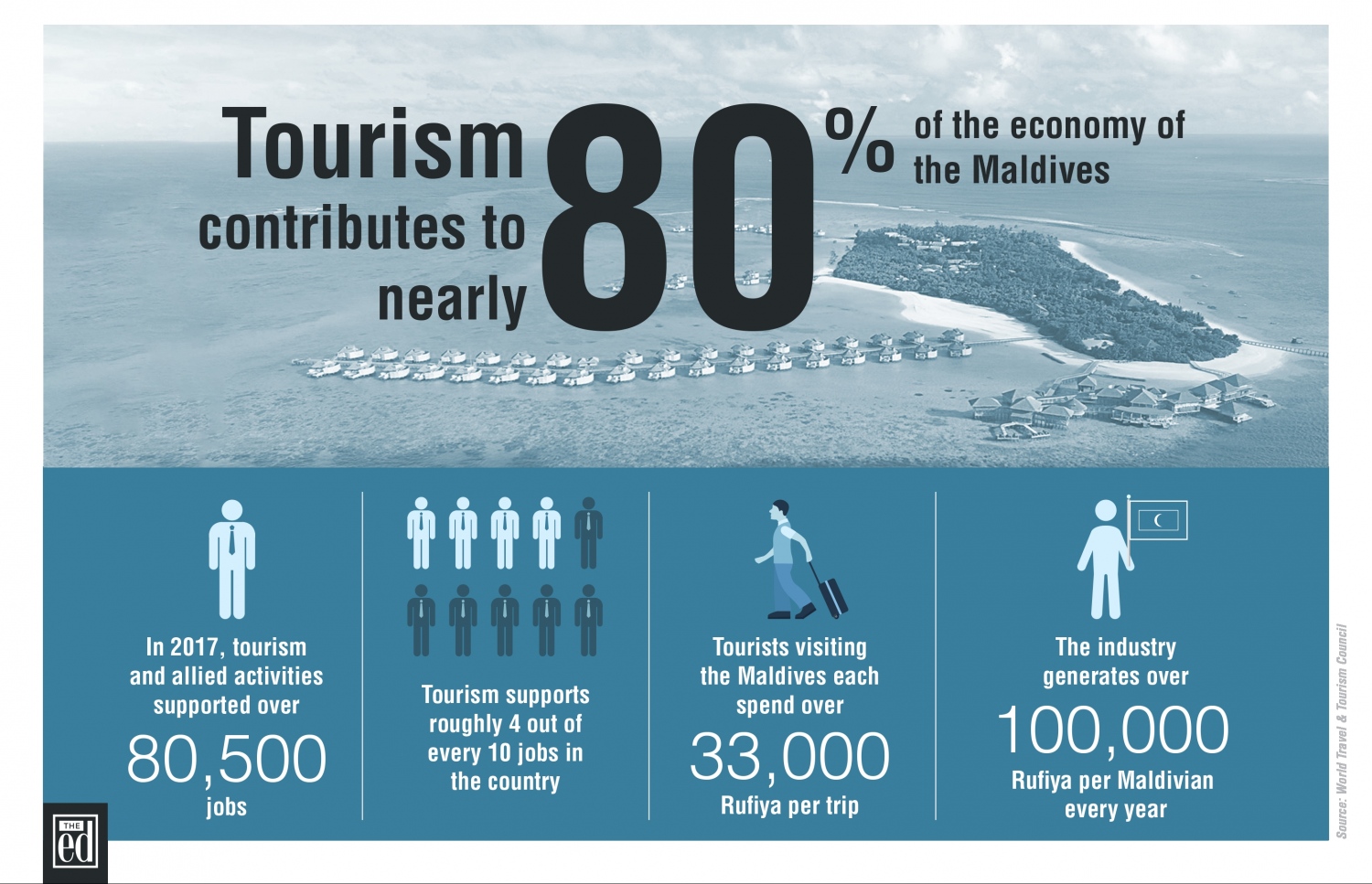

A quick glance at most facts and figures of the tourism industry paints a rosy picture too. Nearly 1.4 million tourist arrivals in 2018 for a country with a population of just 436,000. Tourism-related earnings of over MVR 100,000 per capita. Tourism being the single largest employer in the country, accounting for 4 out of every 10 jobs. In short, the Maldives and tourism are now synonymous, and the fortunes of the common man are inextricably linked and increasingly dependent on this industry. A closer look perhaps may help us understand the health of the tourism industry better.

Growth

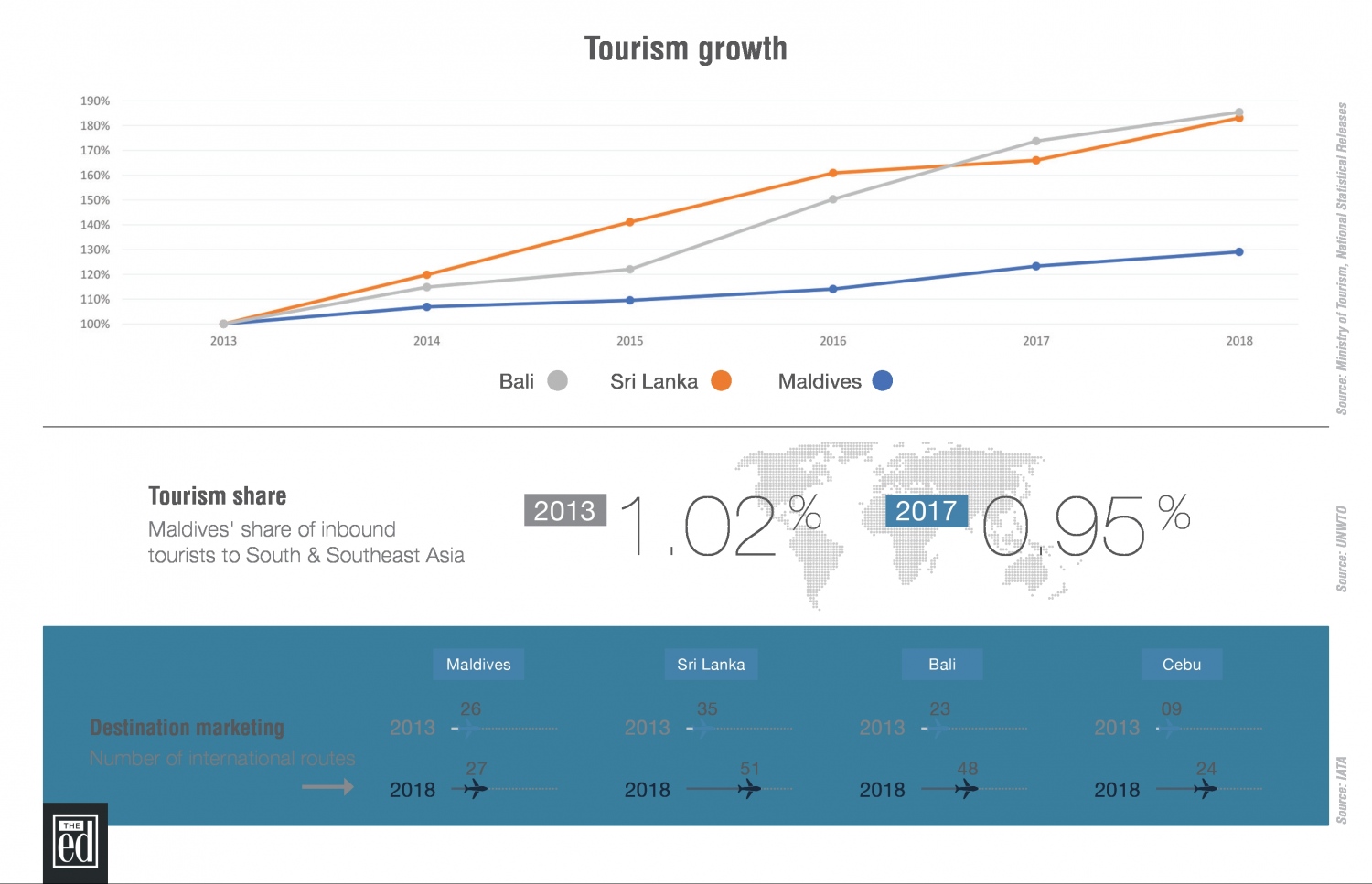

It may come as a surprise to many, but in recent times the Maldives has been one of the slowest-growing tourist destinations in the region. Bali touched one million tourist arrivals 15 years ago, and since then it has never looked back. In fact, over the last five years, Bali's tourist arrivals have increased by nearly three million tourists. On the other hand, the Maldives touched one million tourist arrivals in 2013. However, over the last five years, the country has seen the addition of a paltry 325,000 tourists. It clearly seems as though the Maldives has lost the plot somewhere during this time, with rival countries mopping up most of the tourists.

According to Ministry of Tourism's statistics, the country currently has nearly 42,000 operational beds, which can support more than two million tourists a year. The industry registered an average occupancy level of barely 60 percent in the past year, which was the lowest in a decade. The situation is much worse for guesthouses, which are struggling with an unviable 30 percent occupancy rate.

Why is tourism growth so slow and occupancy level falling? Understanding how tourists make their travel decisions, and analysing the factors that influence their travel choices will help provide insight into the above.

Marketing

The ‘Maldives’ is a premier brand internationally, and it doesn’t look like the sun will set on the brand itself any time soon. However, as the above statistics clearly show, we have not come anywhere close to maximising the brand’s potential, especially considering the speed at which other competing destinations have grown. Every year, the government spends millions on promoting tourism in the Maldives. Even in 2018, a budget of USD 3.3 million was allocated by the government. These are typically spent on extravagant booths and sprawling exhibits at international travel fairs – evidently, this strategy does not seem to be enough to influence travellers anymore.

Industry experts say that in order to stimulate demand, there needs to be focused and proactive efforts to diversify source markets. This would involve extensive planning and identification of international routes that are viable from the Maldives, and conducting roadshows in those specific markets, among others. Crucially, the airport operator, airlines and industry stakeholders all need to act in concert – which is not happening at present. A sobering example of the current state of affairs is that in the past five years, there has effectively been no net increase in the number of international routes to the Maldives. Compare this with Cebu (Philippines), which has gone from serving seven international routes in 2014 to 24 routes at present. Creating new markets is an immense task, and it is obvious that without coordinated demand-stimulating, destination-centric marketing efforts by all industry players - resort and guesthouse operators, local, international and online travel agents, airlines, airport operator etc. - our tourist targets will continue to be a pipe dream.

Thoyyib Mohammed, CEO of Maldives Marketing and Public Relations Corporation (MMPRC) stated that his priority is to focus on developing strong online platforms and utilizing social media to reach a wider audience. A further plan is underway to explore new markets. Despite being on the job for less than two months, Thoyyib is already looking to implement a plan involving extensive consultations with the industry.

Infrastructure

Comfortable flights, convenient airport services, and easy access to resorts and guesthouses define the tourists’ first impression of any destination. These steps have been actively pursued by rival destinations, but have we made any strides?

Bali more than tripled its airport capacity from eight million to 25 million annual passengers in 2014, and built road infrastructure to connect the airport to main tourist spots. Phuket too nearly doubled its airport capacity from 6.5 million to 12.5 million annual passengers in 2016. Such improvements are vital, since they pave the way for airlines to start new routes and expand markets. Since most tourists to the Maldives arrive by air, ensuring the availability of adequate airport infrastructure and convenient flight options should be a top priority for us. Thus, in our case, the airport operator and airlines must play a crucial role in attracting and bringing tourists to the country.

Developments at Velana International Airport - the primary gateway to the Maldives - has been quite limited over the last five years. Barring the frequent name revisions, there have been very few actual infrastructure enhancements on the ground. Its shabby buildings, outdated processes and poor customer service are possibly the worst part of holidaymakers’ travel experiences to the Maldives. Development of airport infrastructure must be undertaken in a planned manner, with a focus on unlocking tourism potential. For instance, the newly-built USD 400 million runway is not of much benefit for the tourism industry, as it does not have a direct impact on the passenger handling capacity of the airport. Such isolated projects carried out without any long-term planning only adds to the country’s debt burden. A development plan for the airport must instead be centred on capacity augmentation and service upgradation based on a long-term masterplan – areas which are hardly paid attention to today!

Domestic travel infrastructure and connectivity is equally important. In every country, gateway infrastructure such as air and sea ports are typically complemented by adequate and cost-effective domestic travel options. In the Maldivian context, the development of cheap inter-island connectivity is all the more important to support the guesthouses, because conventional means of transport such as seaplanes and domestic air travel are too expensive, and speedboats are limited by their range. If guesthouses are to spread throughout the country, then cheaper travel options ought to be developed, such as regular passenger ferry services to outlying islands.

Way Forward

If we have to attract tourists, demand has to be simulated in new and old markets. Additionally, pain points at every step of a tourist’s trip to the Maldives need to be dealt with – from the availability of inbound connections to Malé, to immigration processing at the airport, to convenient modes of transportation to the resorts and guesthouses. All of these must develop in tandem if the industry is to grow and realize its full potential. It is also equally important to create a comprehensive 5-year tourism master plan that encompasses the marketing and promotion of new tourism regions and experiences in the Maldives. In short, the country is in dire need of a holistic approach to marketing and infrastructure planning, without which it will be hard to turn around the fate of the tourism industry – the bread and butter of our country.