The Auditor General's Office has said that HDh. Filladhoo may incur losses totaling MVR 69.9 million for the 66 plots they leased for 50 years in order to expand tourism.

An audit was conducted regarding whether Filladhoo Council spent their 2024 budget as per the island budget that they had decided and passed. The audit reads that due to the proposals being evaluated against the regulations prepared by the council office for leasing plots and due to agreements being prepared in contrast to the proposals, losses totaling MVR 69.9 million would be incurred within the agreement's time frame.

The report states that the total revenue that would be generated for the duration of the rent period was not taken into account in awarding marks to proposals that were submitted regarding some of the rent plots that had year-on-year rent increases. Instead, due to the evaluations being done by looking at the price submitted in the first year, more points were awarded to those who were not supposed to receive the plot, with said individuals receiving the plot.

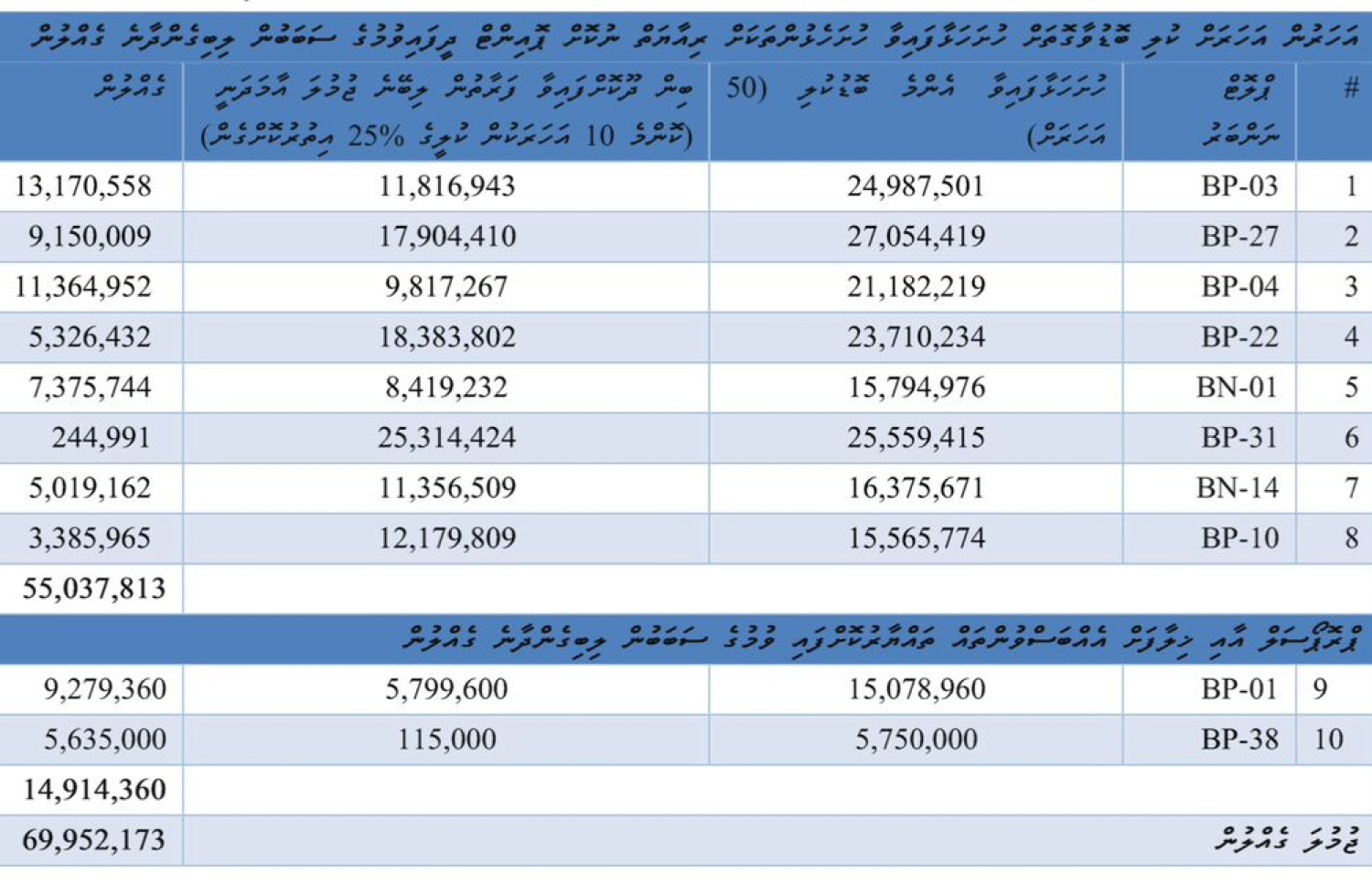

As the proposals were evaluated as such, the audit report states that eight of the rented plots would see monthly rent increases by 25 percent every 10 years. This may add up to a total revenue loss of MVR 55 million for the council office, as per the report.

The audit stated that increasing the monthly rent by 25 percent every 10 years is optional, there is a possibility that the loss figure could go up to MVR 100 million when making calculations without the monthly rent increase.

The audit also reads that CSR and rent articles were included in some agreements against the submitted proposals regarding plot rent. As an example, the audit reads that even though the proposal for Plot Number BP-01 included the year-on-year rent increase, the office had prepared the agreement with the initial figure of MVR 2 for 50 years as the rate for monthly rent.

The audit states that this may see loss of MVR 9.2 million in rent funds for 50 years to the office.

As per the audit, even though MVR 115,000 would be given yearly as per Plot Number BP-38's proposal, CSR is to be given as per the plot awardees agreement, which is an yearly minimum of MVR 57,000 totaling MVR 115,000. The audit states that due to this, a loss of MVR 5 million may be incurred within the agreement's time frame.

Details of the losses incurred due to tourism plot evaluations and how the agreements were made

The audit went on to state that a regulation regarding the plot application process for council office employees and affiliated parties was not compiled. The audit also stated that meetings were held between members regarding stakeholder matters against local council general procedure rules.

The report said that two employees and two members received plots totaling 131,660 sqft split into six beach front plots, three waterfront plots and a reefside plot. Three employees and individuals affiliated with two members had also received a plot totaling 81,614 sqft split into five beachfront plots and four waterfront plots.

Additional issues:

- Proposals that were submitted on 14th June 2023 regarding the awarding of plots near the harbor on a commercial basic not being provided for the audit.

- The council office having not received MVR 199,856 from the total they were owed, with them not working to recover said money as per the rules.

- No bank reconciliation being prepared, in regards to the council office's accounts.

- No proper monitoring system having been established in regards to plot work progress.

- Plots not ready for use as a system to provide basic services was not arranged before the plots were given away.

- Plots being sold by awardees to other parties.

- The council not receiving MVR 30.6 million as the council decided to increase the load forgiveness window from three months (as per the regulations) to 24 months.

- The office accepting a vehicle that was supplied against specifications, and a large portion of the agreement being paid before the vehicle's registry was transferred to the council's name.

As a number of issues were highlighted, the council has been told to conduct council account operations as per the Public Finance Regulation. The council has also been told to check whether the funds in council accounts are correct at the end of every month, with reconciliation statements to be prepared and for signatures from those who prepared the statements along with the individual who is financially responsible to sign the statements and to file them.